“EPA emissions ruled them all out.”

It doesn’t sound like a sales pitch so much as a farewell. In a TikTok filmed on a Wisconsin dealership lot, a Chevrolet salesman takes a look at four remaining 2025 Malibus and casually delivers a grim line: “They’re done.”

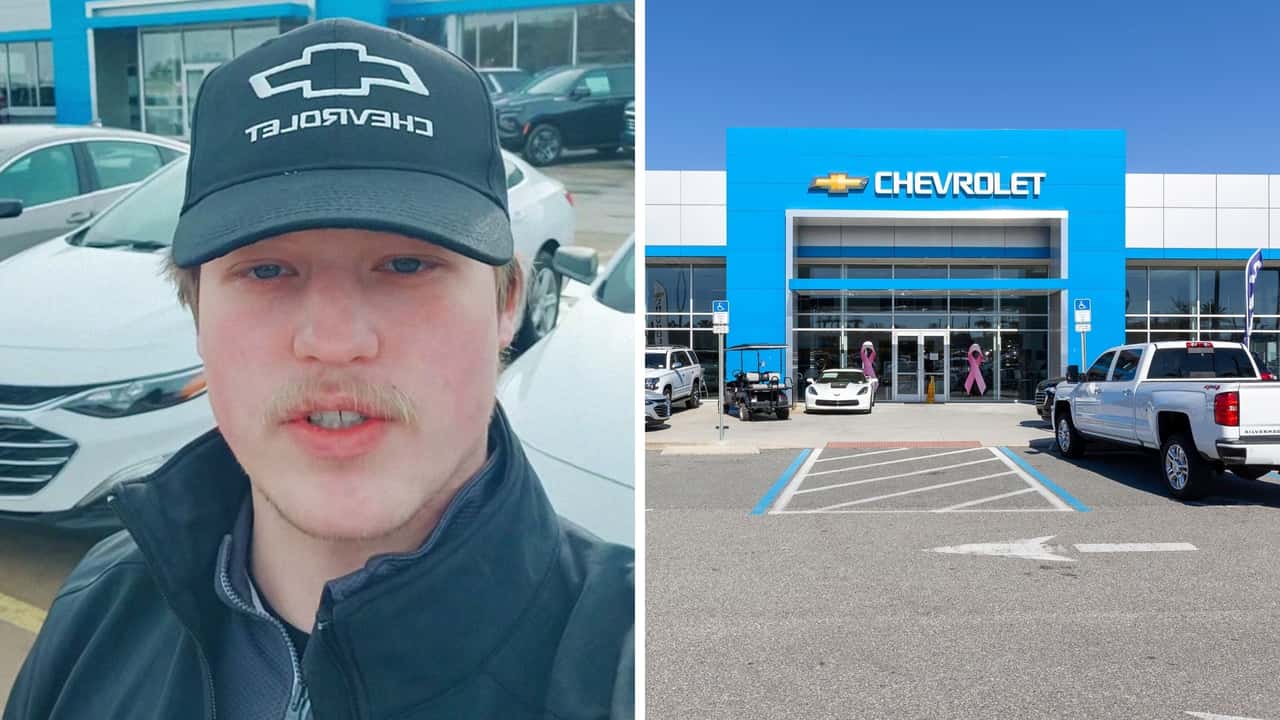

The clip from Avery Bence (@askaveryauto), a salesman at Ewald Chevrolet in Oconomowoc, Wisconsin, fills viewers in on the hard-to-believe news that the Malibu has reached the end of its run as a mainstay in the Chevrolet product line.

“EPA emissions ruled them all out. They’re probably not coming back,” he said in the clip. “They’re all priced around, I’m pretty sure, 16, 17 grand.”

The Chevrolet Malibu ending its run after the 2025 model year isn’t a sudden development, even if it feels abrupt to casual buyers. General Motors has been steadily retreating from the midsize sedan segment for nearly a decade, focusing instead on higher-margin crossovers, trucks, and SUVs. Once a core offering for Chevrolet, the Malibu has seen declining year-over-year sales as consumer demand shifted toward taller vehicles with available all-wheel drive and greater perceived utility.

GM has not framed the Malibu’s discontinuation as a failure of the model itself. Instead, company executives have repeatedly emphasized a broader realignment of capital and engineering resources toward electric vehicles and profit-heavy segments. In that context, low-volume sedans become harder to justify when the same investment can generate higher returns elsewhere in the lineup.

Bence’s claim that “EPA emissions ruled them all out” reflects a common belief among consumers and dealership staff, but it only tells part of the story. Federal fuel economy and emissions standards, overseen by the Environmental Protection Agency (EPA), become increasingly stringent over time, and automakers must invest heavily to keep aging platforms compliant. However, regulations alone did not doom the Malibu.

What ultimately worked against the car was math. Updating a midsize sedan platform to meet future emissions and efficiency targets requires substantial reengineering. For vehicles that sell in relatively low numbers and carry thinner margins, automakers increasingly choose to walk away rather than redesign. The Malibu wasn’t forced off the market so much as it was deprioritized.

The Malibu’s exit becomes clearer when compared with rivals that remain. The Toyota Camry, for example, continues into the second half of the decade thanks to strong global sales, hybrid powertrains that help offset emissions requirements, and Toyota’s long-standing commitment to sedans as a core product. Honda’s Accord followed a similar strategy, consolidating trims and emphasizing efficiency rather than performance.

Chevrolet, by contrast, does not offer a hybrid Malibu in the US market, nor does it sell the car in enough global volume to justify a full platform refresh. Without those advantages, the Malibu was left increasingly isolated within GM’s portfolio.

One of the more revealing details in Bence’s video is that all four remaining cars on his lot are fleet vehicles. Fleet sales to rental agencies, corporate buyers, and government entities have kept the Malibu alive longer than retail demand alone would have allowed. Fleet buyers value predictable operating costs, straightforward maintenance, and familiar platforms over styling updates or cutting-edge tech.

As a result, the final Malibus reaching dealer lots tend to be lower trims with conservative specifications, not enthusiast-focused variants or special editions. That reality underscores how quietly the model is exiting the market. There is no send-off package or commemorative badge, just the gradual depletion of inventory.

Bence’s mention of pricing “around 16, 17 grand” likely reflects lightly used fleet vehicles rather than new retail inventory, but the figure still resonates. Affordable, straightforward sedans have largely disappeared from dealership showrooms, leaving buyers to choose between rising used-car prices or entry-level crossovers that cost significantly more.

Chevrolet’s own lineup illustrates the shift. Vehicles like the Chevrolet Equinox and Chevrolet Traverse offer more space and modern features, but at a substantially higher transaction price. For budget-conscious buyers who simply want efficient transportation, the loss of cars like the Malibu narrows options rather than expanding them.

Bence openly admits he enjoys driving the Malibu and that his family has owned several. He describes the car as intuitive and responsive, praise that feels almost out of place in an era when dealership videos typically focus on screens, software, and monthly payments.

That moment of personal attachment highlights a broader disconnect between consumer experience and corporate decision-making. Cars that drivers appreciate for their simplicity and road manners don’t always align with the financial priorities guiding modern product planning.

Chevrolet has not announced a direct replacement for the Malibu, and none appears to be on the horizon. Electric vehicles are expanding across GM’s lineup, but they occupy a different price and use-case bracket. For now, there will be no true successor offering the same blend of size, efficiency, and affordability that once defined the Malibu nameplate.

Instead, the car joins a growing list of discontinued sedans whose absence is felt less through press releases than through dealership lots slowly emptying out. In that sense, Bence’s TikTok functions less as a sales pitch and more as a quiet marker of change that reflects where the American car market has already gone, rather than where it’s headed next.

Motor1 reached out to Bence via phone and direct message. We’ll update this if he responds.

We want your opinion!

What would you like to see on Motor1.com?

– The Motor1.com Team